Content

Term dumps are generally said to be a very safe investment since there’s little to no risk of dropping your bank account. Ranging from Oct 2008 and you can March 2012, the newest make sure secure places around $step one,100000,100 as the a temporary scale to aid publication Australia’s banking field from the International Overall economy. You’ll find higher output from other champions, and you may’t deposit dollars. So it account is an excellent option for savers searching for an excellent no-cost account one to earns a strong APY for the all the balances. You might create the new Truist One to Currency Field Membership because the automated backup in case you happen to overdraft a preexisting Truist examining account.Disclosure step three Excludes Truist Believe. There have been the most well known and you will outstanding robberies of the many go out.

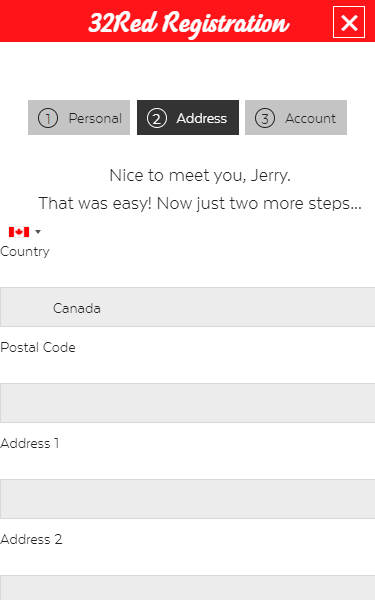

If you aren’t a customers but really:

The new Mitchell Financial, Schlesinger’s greatest financial, collapsed, while the performed three someone else which had produced large fund so you can your. Schlesinger prevented investing his financial institutions and very quickly lost the newest Chapin Mine. Neither Nuclear Dedicate nor Nuclear Broker, nor any of the associates is a bank. Assets in the securities are not FDIC insured, Perhaps not Lender Secured, and could Lose Value. Using relates to risk, for instance the you’ll be able to death of prominent.

Best High-Yield Savings account Costs Today

High-desire deposit profile try federally insured profile given have a peek at the web-site by banking institutions and borrowing from the bank unions (and regularly nonbank team). He or she is secure cities to put your money you to definitely earn an based speed out of return. However, one to come back is often below you could secure over the years for many who put your money in a riskier investment automobile, such stocks and you can securities. Having assets, you can generate a far greater give across the long haul, but there is in addition to a risk that your account you are going to remove worth. Most top $step 1 deposit casinos on the internet undertake debit and credit cards and you can age-purses including PayPal. Particular may even give cryptocurrency, whether or not this can be less frequent.

Evaluate the best desire savings accounts

Regarding withdrawing your own payouts, you need at least $50, since the limit you could potentially withdraw per week is actually $cuatro,000. There are not any additional costs or costs when making on the internet purchases. Although not, you might encounter an excellent 2.5% conversion percentage when to experience in another currency. This is really produced in the new fine print, thus make sure you review the newest fine print ahead. Yes, social gambling enterprises in the usa enables you to enter award competitions. This type of competitions give players the opportunity to earn real cash awards.

You could withdraw early from an expression deposit, however, if you do not’re experience financial hardship, you always is also’t exercise instead of up against a penalty. To really unlock the definition of deposit, you may either exercise online otherwise by going to a region department. Certain organizations might need one be a preexisting customers so you can unlock an expression deposit online.

UBS Individual Riches Management

CIT Lender is actually a division out of Basic People Lender, and you can right now their Platinum Savings account brings a speeds from 4.10% APY. When you are young folks are very likely to provides informative personal debt (40.1% of people below thirty five yrs . old performed inside the 2022), they bring the lowest matter, a median from $18,100000. Old People in the us old 55 to help you 64 hold the best student loan balance during the a median out of $41,100. You to profile features nearly doubled as the 2010, whether it try $21,440.

In my opinion my personal very first-hands feel can make myself uniquely capable to upgrade subscribers. In addition to, you can earn an additional 0.10% APY added bonus for being an enthusiastic AARP member. There is no need in order to maintain the cash on your membership – you could potentially withdraw they any moment. Your own Rare metal Family savings have to are still unlock if the extra is credited. Home loans across the the classes became from the 0.9% from the last one-fourth away from 2024 to the basic one-fourth of 2025, depending on the Government Reserve Lender of brand new York.